by Tom Neeser | Oct 11, 2023 | Blog, Life Insurance, News

Every week, someone asks us if we can help them with their Medicare. It became apparent that our clients needed a resource to answer their questions about Medicare and someone who could explain how it works in an easy-to-understand manner. So…we are very...

by Tom Neeser | Aug 30, 2023 | ANNUITIES, Blog

People are living longer, which means the length of their retirement is longer, too. Many people may face the fact that they will outlive their savings and be caught short. Creating a strategy that provides you with the income you can count on is becoming...

by Tom Neeser | Aug 2, 2023 | Blog, financial planning

Hidden Costs of Investing Most people assume that if they have a 401k or IRA, they are paying little to no fees. This lack of understanding of how these plans charge fees can cost you thousands of dollars. The average fee is 1-2% a year. According to the Department of...

by Tom Neeser | Apr 14, 2023 | Blog, financial planning, Life Insurance, Whole Life Insurance

Infinite Banking is a lot of things, but there are several things that Infinite Banking definitely is NOT: A GET-RICH-QUICK SCHEME. Or a scheme of any type. Infinite banking is a disciplined approach to taking over the banking function in your life. A TRADITIONAL...

by Tom Neeser | Mar 3, 2023 | Blog, financial planning, Personal Finance, Retirement Alternatives

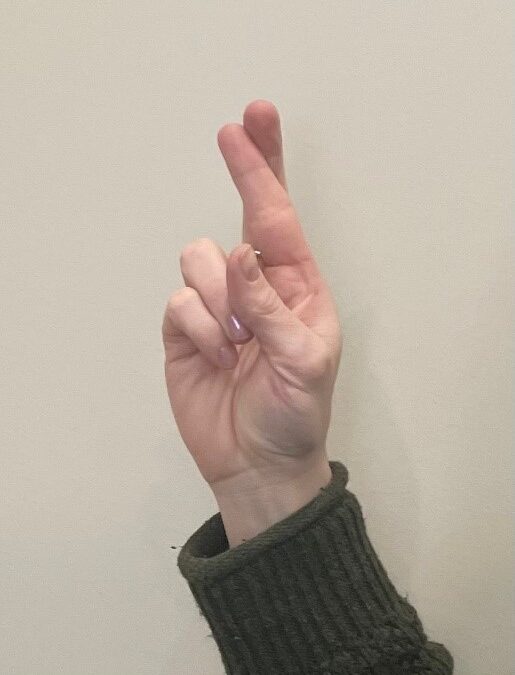

“Cross your fingers and hope for the best.” Unfortunately, this seems to be one of the most popular retirement strategies around – and as you can imagine – it is a disaster waiting to happen. If you want to have a plan that is predictable, guaranteed, and grows...