Do you have access to cash on-demand, or are you locking up your assets? The answer may be influencing your prosperity more than you realize.

Most investors focus on the Return on Investment. However, locking up money in investments where it is no longer liquid can severely limit the possibilities for lucrative returns! Why? Because some of the best opportunities cannot be capitalized without access to cash.

Most accumulation vehicles lock up your dollars.

- If you put money into a retirement plan, your money stays there, sometimes for decades.

- If you put money in an educational savings plan, that’s where your dollars remain until needed for tuition.

- If you invest in a business or real estate deal, your cash is locked up there for a certain length of time or until the investment is liquidated.

- If you purchase a car with your dollars, your money is now on four wheels in a depreciating vehicle.

Usually, you must liquidate assets or divest yourself to get access to use your dollars elsewhere. It’s “either/or” – you can either earn interest on your savings, earn returns on your investments, or liquidate them to spend the money, but you’ve got to make a choice.

Life Insurance: The Both/And Asset

Todd Langford of Truth Concepts financial software often says, “Most assets are either/or assets, but (whole) life insurance is a both/and asset.” This is a perfect way to describe the advantage of having an asset that can be easily used as collateral.

Cash-value life insurance is a “both/and” asset. As you keep funding your life insurance policy, the cash value grows, and before you know it, you have options. Do you need money for an emergency, a lucrative opportunity, a honeymoon, a business start-up, or a down payment on a rental property? Go right ahead – the money is there for you to borrow against.

While you could simply withdraw the cash from your policy (using it as an “either/or” asset), you can also leave the cash value IN your policy – earning future dividends – and borrow against it. By accessing capital with policy loans, life insurance becomes a “both/and” asset.

Your savings continue to grow and earn while you gain access to the cash you need for an emergency, an investment, or a major purchase. Then, you can repay the loan on your own schedule. Extra payments or a lump sum? Of course! Need to skip a couple of payments? No problem. However, we do recommend that you diligently pay back your loan, as that will minimize interest and will give you access to borrow against the cash value again, should you need or want to.

Financial author and speaker Nelson Nash was fond of saying, “If you have cash, an opportunity will seek you out!” Here are 5 examples of how opportunities can find you when you have access to capital:

- Cash in on an Opportunity

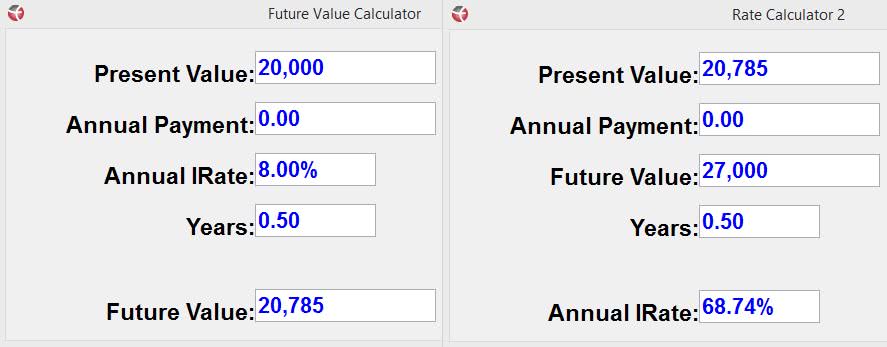

Perhaps a friend wants to sell a classic car for much less than what it’s worth to generate some quick cash. The car can fetch $30k for a patient seller in the right market, but he’ll take $20k if you can get him the cash next week. Let’s say you buy the car at $20k and resell it for only $27k. You borrow the $20k against your cash value, pay 6 months of interest at an 8% annual interest rate (an additional $785). You’ve just generated a $6,215 profit, or an annualized return of 68.74%!

- Be the Bank

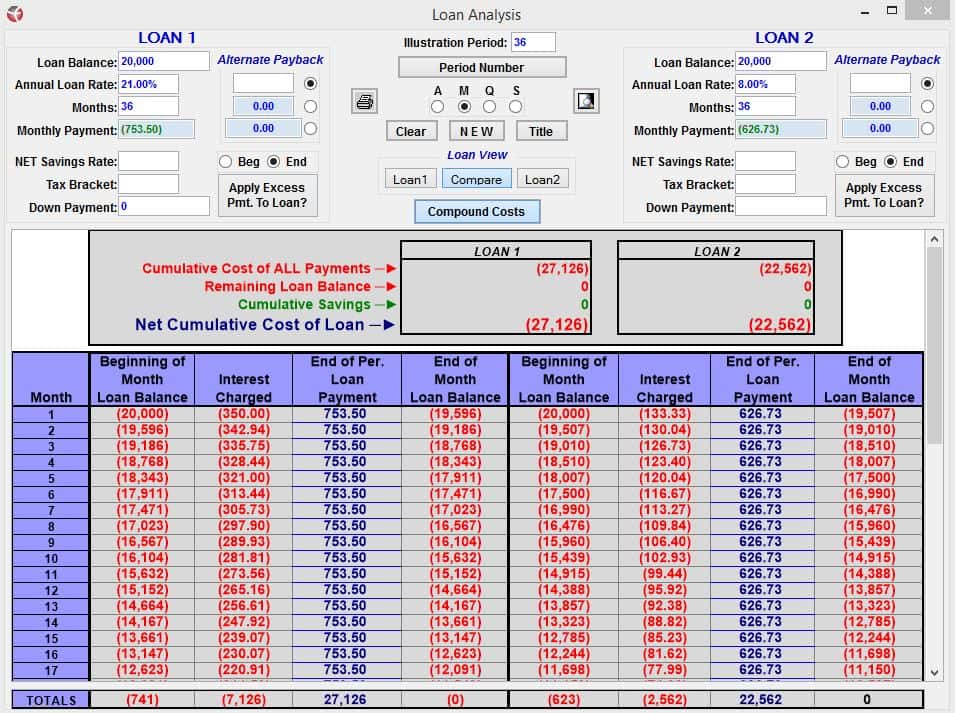

Perhaps your business needs some new equipment, and you discover that the lease on the new machines will cost you the equivalent of a three-year loan at 21% annual interest rate. Even worse, if you prepay the lease, you’ll STILL pay the steep financing fee.

You could save thousands by providing your own financing in such a situation… all because you had access to cash. In the example below, a $20,000 loan (or lease equivalent) at 21% interest will cost $27,126, while an 8% interest loan over the same time period, only $22,562:

Earn Cash Flow

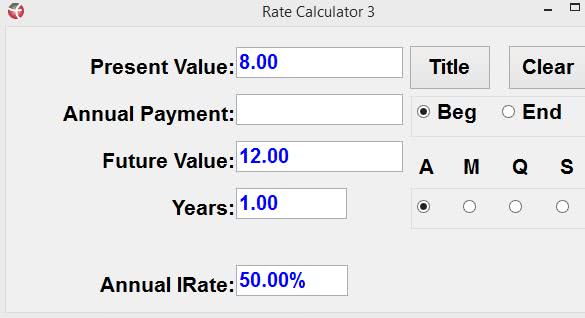

Let’s say the business equipment scenario above isn’t your business, after all, but the business of a friend or family member. Could you offer to finance the equipment at a rate of 12%? It would be fantastic savings for them, and you could borrow cash at 8% from a policy loan (no questions asked) and earn 12%.

You would be making 50% on your money while saving them thousands!

Don’t mistake this strategy as a mere 4% gain – 4% being the “spread” between the cost of money at 8% and the rate at which you can lend the money, or 12%. If you bought a widget at $8 and sold it for $12, it would be a 50% profit. It is the same when buying and selling cash.

- Create an Income

When you have access to cash, you can keep your eyes and ears open for exceptional business or real estate deals that could set you up with long-term income.

One investor used his cash value to invest in cash-flowing commercial real estate that generated an income for him after being forced into an early “retirement” with a disability. His disability rider kept the policy funded, now at no cost to him. But he took it a step further and capitalized on his whole life policy. Using policy loans and the leverage of a mortgage, he was able to fund multiple real estate deals, which enabled him to continue to support his family.

Take the Opportunity of a Lifetime

Sometimes, the “return on investment” isn’t financial at all, it’s personal. Perhaps it’s taking the trip of a lifetime, or checking a major item off of your bucket list. You can access the money you need, when you need it, with no questions asked and repay it on your own time schedule.

The Cost of Cashing Out

Many people consider their 401(k)s or IRAs to be their “savings.” But qualified retirement plans aren’t liquid and make poor piggy banks. You’ll pay income tax and possible penalties, which can gobble up nearly half of any withdrawals! In 2010, Americans paid $5.8 billion in penalties alone by tapping $58 billion in retirement funds before they were supposed to, according to a 2014 Bloomberg article.

Borrowing 401(k) monies for allowable reasons (such as a home down payment) is also deceptively expensive due to the tax treatment. You will have to replace those before-tax contributions with after-tax dollars, which means you can add your tax bracket rate to the cost of the loan!

Capitalizing with Cash Value Insurance

When you have a solid, liquid asset such as life insurance cash value, you can leave that asset intact, and easily borrow against it. This leaves you with your original savings plus access to your cash. Best yet, your savings will keep growing, off-setting some of the interest costs. It’s also possible to use your policy cash value to obtain a bank loan at an even lower interest rate.

You can argue that a certificate of deposit could give you the same advantage of liquidity – after all, what bank won’t lend against their own certificate of deposit? However, here again, we discover that whole life insurance is a “both/and” asset” in the way that other savings vehicles are not.

Typically, you have to choose between investments, savings, or insurance vehicles. With whole life insurance, however, you are saving and insuring at the same time. Not only will you eventually have access to every dollar put into the policy as your cash value grows, you’ll also have protection over and above the cash value the moment your first premium is paid.

In this way, life insurance is a self-completing savings strategy. Should something happen to you, the policy can still pay for your child’s tuition or supplement your spouse’s future income.

Can You Capitalize on Opportunities?

Whole life insurance is the best place we know to store long-term cash (with a permanent self-completing savings mechanism) and the best way to build liquidity for future investments, emergencies, and opportunities.

Contact us at NeeserInsurance.com or give us a call at 574-234-1980. We can show you how a whole life policy can be a risk-free, essential component of your wealth-building strategy.

All calculator illustrations from Truth Concepts software.

©Prosperity Economics Movement