Are you 100% sure you’ll have a great retirement, or do you have some doubt?

Are you 100% sure you’ll have a great retirement, or do you have some doubt?

What if I could show you how to be out of debt many years sooner than you thought possible, (often 9 years or less – including your mortgage) without spending any more money than you are spending right now?

Do you have a mortgage, credit card debt, a student loan or car payments? Are you on track to be in debt for the next 20-30 years or longer? Is debt weighing you down and you feel like you will never get out of debt? You are not alone; many American find themselves drowning in a financial mess – they have good intentions to be further ahead but just can’t seem to get there with taxes, interest, tuition, inflation, the rising cost of health care, and countless other expenses and responsibilities.

The good news is you do not have to stay in this situation. Not only can you get out a debt you can also build a tax-free retirement, without spending any more money and without taking risk. I can teach you how to become your own bank.

It is not a complicated process – you can stop paying banks and lenders and make every dollar you earn work for you. Wouldn’t you like to avoid risk and secure your future with guaranteed growth you can count on?

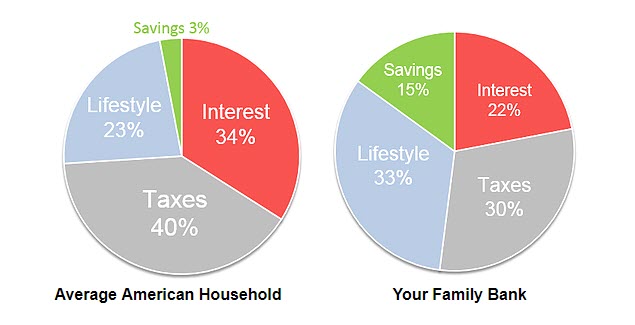

The average individual pays 34% of the money they earn to interest. This interest goes to cars, credit cards, student loans, mortgages, all the things we finance is interest going out …and on top of that we have taxes to pay!

About $.40 of every dollar the average American earns goes to taxes.Everything from income tax, sales tax, capital gains tax, gas tax, estate tax, etc. This leaves approximately 26% to pay for everything else like vehicles, clothes, insurance, gas, etc. I call this Lifestyle money. Of this amount, only about 3% goes to savings.

Most financial advisors concentrate on that 3% savings and will tell you “You’ve got to save more money and take more risk,” but most people just aren’t able to save any more than they already are and have no desire to assume more risk. We focus on the problem – the 34% going to interest and the 40% going to taxes.

What if we could reduce that 34% going to interest and the 40% going to taxes? This would allow for more lifestyle money and would also free up cash to contribute towards savings!

Let’s look at how banks leverage cash flow

You put $10,000 in the bank, and the bank may pay you 1% interest on those funds.

Walk in the next day and try to get a $10,000 loan, what would your interest rate be – …24%, 12%, 5%, 29%? It all depends on many variables like credit score, what you’re getting a loan for, how much you earn etc. You make 1%, the bank makes whatever percent they choose because banks are a business!

How would you like to be the bank??

- Use your dollar like a bank

- Give every dollar two jobs

- Create compounding interest for yourself

Would you like to learn:

-

- How to grow your wealth, safely and predictably, regardless of what the market is doing?

- How to bypass banks, finance and credit card companies completely, and become your own source of financing?

- How to pay for college without going broke?

- How to eliminate filling out a credit application ever again?

You do not need to be wealthy to take advantage of this system – it is possible to accumulate wealth on any income, and I would welcome the opportunity to show you how.

Want to learn more? Call us to schedule your free, no-obligation analysis today. We are here to help you have a better financial future.