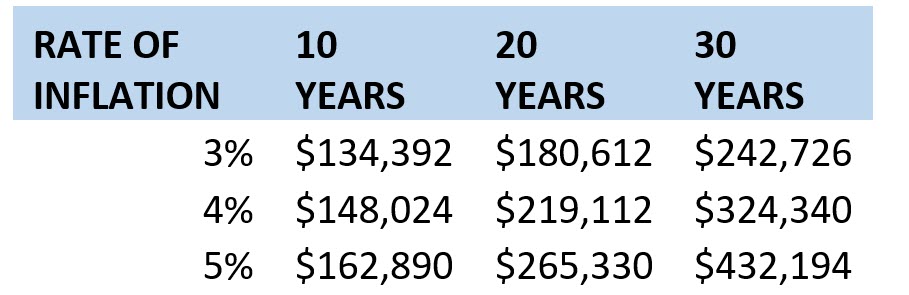

In retirement, no one wants to worry about having enough money. You plan you save, you invest – but you forgot to consider inflation. Suddenly you find yourself running short and beginning to worry what the rest of your retirement years will look like. Do you know how devasting the cumulative effect of inflation can be on the course of 10, 20, 30 years of retirement?! This chart illustrates the annual income needed to equal $100,000 at the modest inflation rates illustrated.

When you are on a fixed income, there is a lot of uncertainty and not many options. You could always increase your withdrawals, which depletes your resources, or you could cut expenses and decrease your stand of living, neither of these being a great option. So what can you do?

Plan for multiple streams of income BEFORE retirement so you can combat inflation effectively. Diversify your investments – do not leave all of your money at risk in the market. Some great, safe options include:

- HIGH CASH VALUE LIFE INSURANCE

- By implementing the Infinite Banking Concept, you have a guaranteed tax-free death benefit, your cash value grows tax-deferred with no market risk, and you can turn on tax-free income at retirement without any social security penalty. All from a pool of capital that you control!

- INCOME-PRODUCING REAL ESTATE

- Real Estate can provide recurring, passive income that doesn’t require much time or effort. Property generally appreciates, and you have the option of selling later if it makes sense for you. Owning rental property allows you to diversify your investments which adds a layer of protection against risk.

- FIXED INDEXED ANNUITY

- An FIA is a retirement planning tool that guarantees you income that you can’t outlive. A general rule of thumb is not to have more than 50% of your retirement saving in annuities. It is important to keep cash on hand to cover living expenses and unexpected costs like car repairs, medical bills, or a new roof.

The average cost of Social Security cost of living over the past 20 years is just 2.1%. According to an analysis of the Bureau of Labor Statistics Consumer Price Index, the cost of living in America has climbed 14 percent over the past three years! The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

To live a retirement free of worry, it is essential to review your finances to know where you stand.

If you are not comfortable with what you see – give us a call, and we can review options with you to build certainty and take away stress and worry.

You can reach us at hello@neeserinsurance.com, visit our website at neeserinsurance.com, or give us a call at 574-234-1980.

We sincerely appreciate all of our friends and loyal clients and hope you will help us continue to grow by sharing this article with your friends, family, and co-workers.