We have all been rocked by the recent market volatility. Maybe you have been lucky, and you’re still ahead — or maybe not so lucky, and you’ve had losses, loss of the money you were planning on living on in retirement. You are being forced to reconsider your time horizon, maybe questioning other choices – not buying that second home, having to put off taking your dream trip, maybe even having fewer dinners out? Some of you feel in your gut trouble is coming but aren’t sure what to do – leave your money where it is and hope to make back your losses, put it in a savings account and make next to nothing, stockpile it in a shoe box and hope for better days.?!

We have all been rocked by the recent market volatility. Maybe you have been lucky, and you’re still ahead — or maybe not so lucky, and you’ve had losses, loss of the money you were planning on living on in retirement. You are being forced to reconsider your time horizon, maybe questioning other choices – not buying that second home, having to put off taking your dream trip, maybe even having fewer dinners out? Some of you feel in your gut trouble is coming but aren’t sure what to do – leave your money where it is and hope to make back your losses, put it in a savings account and make next to nothing, stockpile it in a shoe box and hope for better days.?!

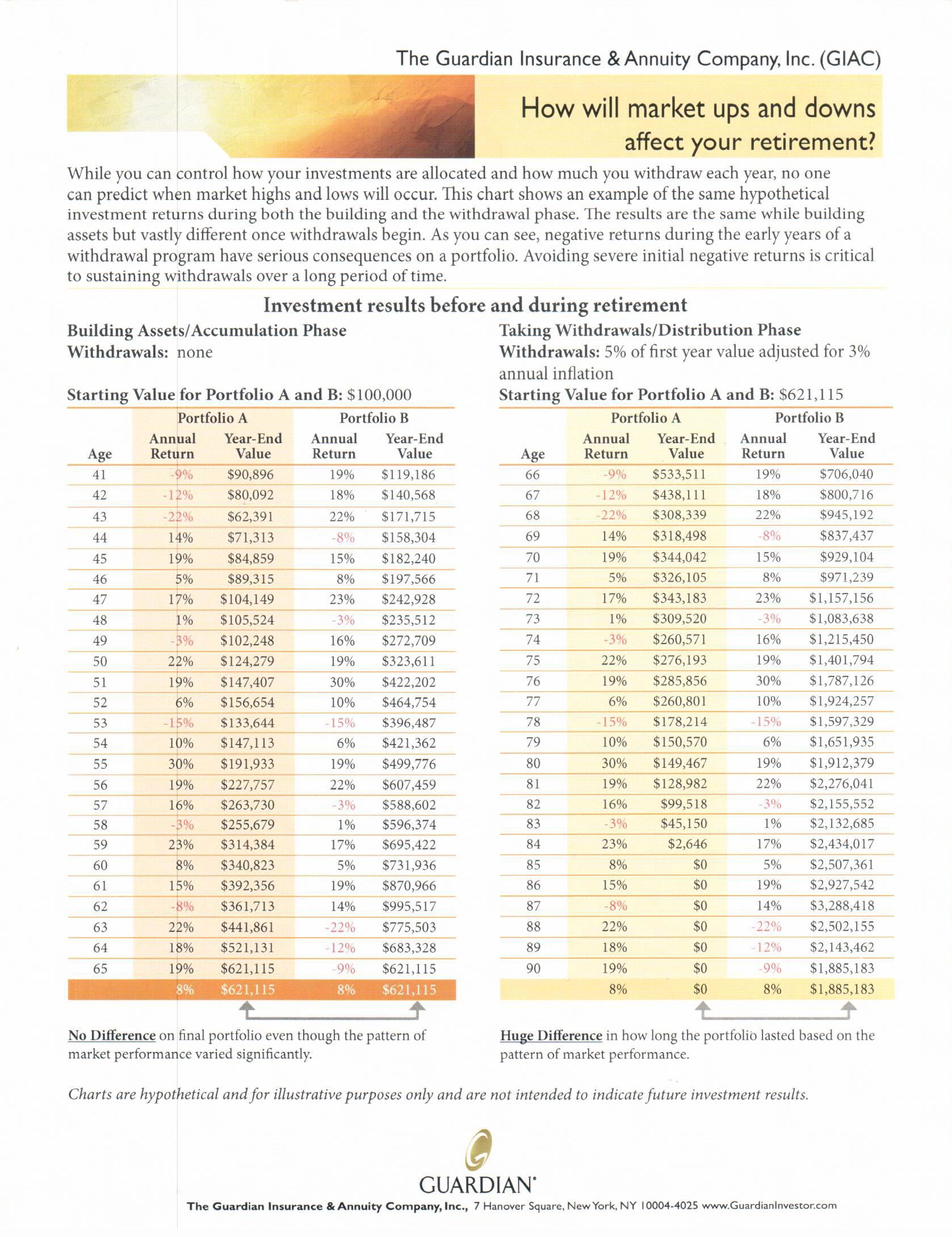

Before I proceed, I have to say that I have absolutely no idea where the market is headed. This may be the bottom, and we may go right back up and break new records, I really don’t think so, but it could. What I do know is this – when you’re getting ready to go from the accumulation phase of life to the distribution phase the sequence of returns will have a huge impact on how long your money will last and this is something that is very important to understand, but your stock broker will never fully explain.

Take a look at the following chart from Guardian Insurance & Annuity Company:

For those of you that are upset that you didn’t move your money sooner, all is not lost. Think about this – the current bull market has had a great run, and most have experienced great gains. You can still take some of those gains off the table before there is a further correction and you have a dire situation on your hands. Let’s consider what happened during the last two downturns. In March 2000 the S&P 500 hit its peak at 1527, but it took until September of 2002 to bottom out at 801. It took 2.5 years to drop 48%. In October 2007, the S&P hit its peak was 1553 and bottomed out in March 2009 at 677. It took 1.5 years to drop 56%. My point is this – do not wait for things to bottom out before making a portion of your retirement savings safe.

If you need predictable income during retirement that you can’t outlive, you should be considering a Fixed Index Annuity. It’s a great tool that lets you participate in the upside of the market with no downside risk. It is not a place for all of your money, but it is a safe place for the portion of your money that you can’t afford to lose and that you want to ensure will be there when you need it most.

HAVE QUESTIONS?

Please give us a call at 574-234-1980 or e-mail hello (at) neeserinsurance.com; we are here to help!