by Tom Neeser | Jun 7, 2022 | Blog, financial planning, Personal Finance

What is the actual annual rate of return you are getting in your mutual funds? Have you considered the effect inflation has on the average return rate? Have you looked at the fees and expenses you pay for your investment accounts? And what about the money in...

by Tom Neeser | Feb 1, 2022 | financial planning, Personal Finance

How much of your 401k is yours? The typical answer is” all of it,” but don’t forget that you owe the IRS taxes on every penny you put in plus taxes on the growth. So conservatively, that’s at least 14% of your total amount and could be much...

by Tom Neeser | Dec 9, 2021 | financial planning, Lifestyle planning, Personal Finance

“By failing to plan, you are planning to fail”Benjamin Franklin Holidays are a great time to gather with family, have fun with friends, and experience the joys of the season. Unfortunately for many, it is also a time for overspending, bad financial decisions, poor...

by Tom Neeser | Sep 9, 2021 | financial planning, Lifestyle planning, Personal Finance

In retirement, no one wants to worry about having enough money. You plan you save, you invest – but you forgot to consider inflation. Suddenly you find yourself running short and beginning to worry what the rest of your retirement years will look like. Do you know...

by Tom Neeser | Jun 8, 2021 | Life Insurance, Lifestyle planning, Personal Finance

Convertible Term Insurance should have a prominent place in your financial plan. So often, the question is: Whole Life or Term Insurance, which is better? The answer is, they both are suitable for different reasons and needs. In this case, you can...

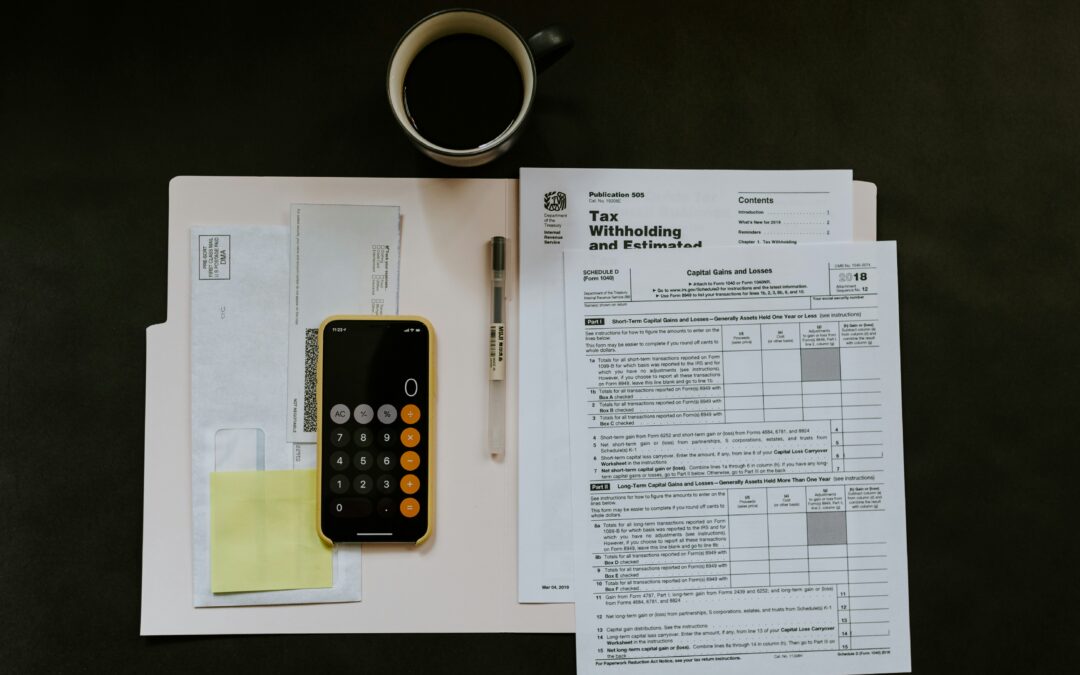

by Tom Neeser | Mar 29, 2021 | Life Insurance, Lifestyle planning, Personal Finance

“The problem in America isn’t so much what people don’t know; the problem is what people think they know that just ain’t so.” Will Rogers Infinite Banking is the concept that was discovered by Nelson Nash and taught in his book,...